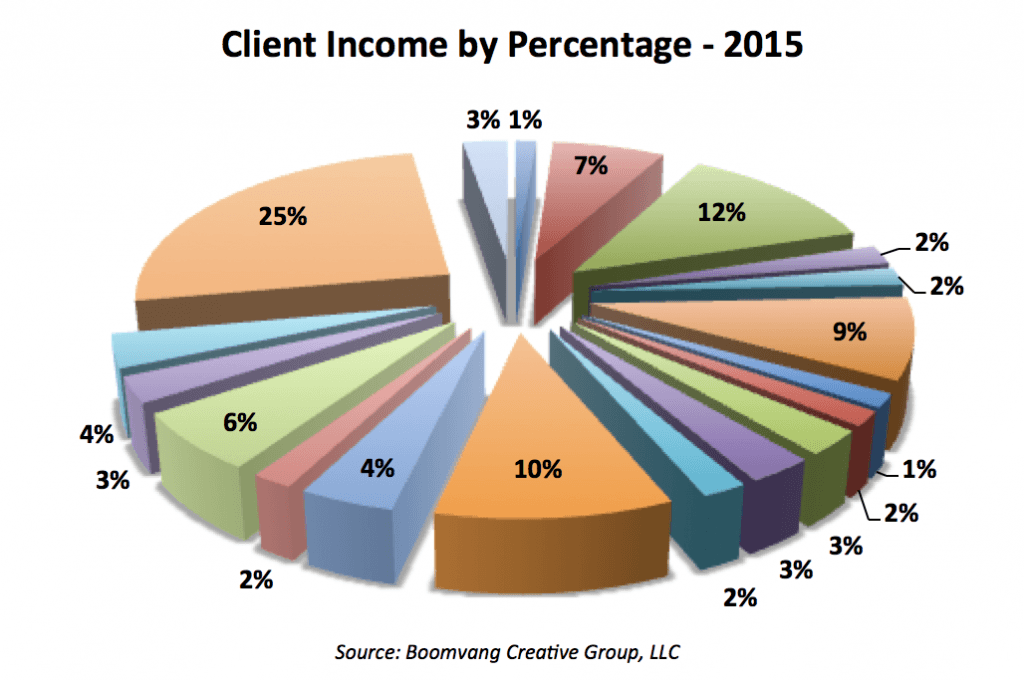

Since you’re already knee-deep in numbers, tax time is an ideal point to take an honest look at your freelance business—not just the top-line income number, but a client-by-client breakdown. The numbers don’t lie, and they could be flashing a warning signal that it’s time to diversify your freelance business. As suggested in last week’s post, client diversity is your best business defense against a freelance client bankruptcy or financial trouble, but there are other reasons to take a dive into the data. [Read more…]

Since you’re already knee-deep in numbers, tax time is an ideal point to take an honest look at your freelance business—not just the top-line income number, but a client-by-client breakdown. The numbers don’t lie, and they could be flashing a warning signal that it’s time to diversify your freelance business. As suggested in last week’s post, client diversity is your best business defense against a freelance client bankruptcy or financial trouble, but there are other reasons to take a dive into the data. [Read more…]

Yeah, about that simplified home office deduction in 2014

I mentioned the simplified home office deduction for 2014 in a recent “Freelance taxes roundup.” On the surface, it seemed like a great idea and appeared to save a lot of time and record keeping. I’m a freelancer, not an accountant, after all. I was happy, if not necessarily doing the Dougie.

Well, it turns out that simplified doesn’t equal maximized, even for an English major whose last math class was college freshman calculus. When I crunched the numbers over the weekend, it turns out that the easy equation—$5 per square foot at a maximum of 300 square feet, i.e., capped at $1500—wasn’t as beneficial to my tax deduction as it was to do it the old fashioned way. [Read more…]

Freelance taxes roundup

If you’re like me, the recent deluge of 1099 forms in the mail is a signal that this weekend is time to get crankin’ on my freelance taxes. I’ve come across a number of helpful links in the past few weeks on the topic, so here’s a quick roundup: [Read more…]

2-Minute Checkup: Freelancer-friendly accounting

Dear Readers: In addition to the usual Q&As, this is the first in a series of “2-Minute Checkup” posts on quick topics that can make long-term impact to your business.

Everyone loves getting a check in the mail, but whether we’re writers, editors, graphic designers, web gurus, or photographers, freelancers often struggle on the expenses/revenues/invoicing/accounting side of the equation. The creative side of the job is more fun. With that in mind, the key is to provide some structure for yourself. Herewith, some thoughts on the pros and cons of a few popular systems: [Read more…]

It’s tax season…do you know where your 1099s are?

Dr. Freelance, if I don’t receive a 1099 for each client who paid me $600 or more, can the IRS penalize me?—Infernally Ravenous Scoundrels

Dear IRS: No, as long as you pay the appropriate taxes on your paid freelance gigs, there is no penalty for not having the actual form 1099s. There’s a wide variety of common 1099-MISC issues, such as if they’re too high or low, have incorrect information, or don’t come at all. Because the rules and regulations are too complex to deal with here, I recommend that you consult the IRS.gov site or your CPA for guidance on how to handle those types of situations correctly. [Read more…]